The end of the fiscal year brings with it a host of tax responsibilities, including the potential need to file Form 1099-NEC. This form is crucial for reporting any non-employee compensation. Let's discuss some less common scenarios where you might need to navigate this form.

The 1099-NEC Tax Form in Special Situations

- Imagine you are a small business owner who hired a freelance graphic designer from another country; even though the work was done entirely online, you may still need to issue a 1099-NEC. The solution? Verify if a tax treaty exists between the US and the freelancer's country to determine your filing obligations.

- Another scenario could involve a joint project where you and another independent business partner equally share expenses and profits. Should you file a 1099-NEC for each other? In this case, consulting with a tax professional can clarify how to report these mutual payments.

Tips on Correcting Your 1099-NEC Template

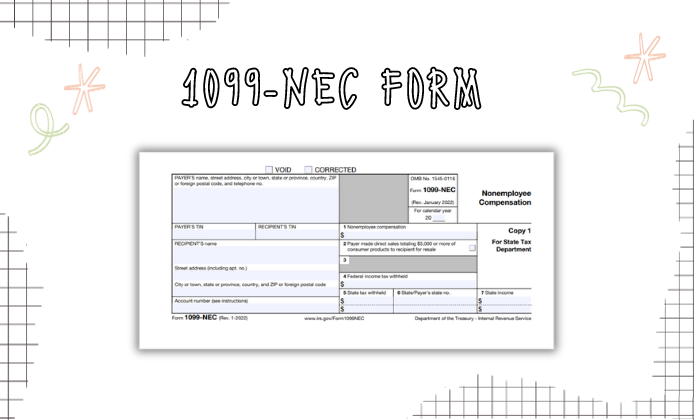

Even the most diligent filer can make an error on their tax forms. If you've already submitted your IRS 1099-NEC form and then spotted a mistake, the approach to rectifying it is straightforward but requires prompt attention.

- Initially, you should correct the form by downloading a fresh copy and checking the box at the top that indicates it's a corrected template.

- Next, send a copy to the IRS, the recipient, and retain one for your records. It's vital to address errors quickly to avoid potential penalties.

- To ensure correctness, you might wish to fill out the 1099-NEC online for free, which can minimize the risks of errors that come with manual completion.

With the many responsibilities that come with running a business or handling freelance work, having access to free resources can be incredibly beneficial. For instance, obtaining a free template of the 1099-NEC can streamline the process, allowing you to enter information directly into a preformatted document that's designed to meet IRS standards. Once you have filled it out to your satisfaction, you can print the document and mail it.

Free Form 1099-NEC: Answering Popular Questions

- Is it possible to file the 1099-NEC for free?

Yes, there are several methods to submit Form 1099-NEC. The IRS offers a free filing service called FIRE (Filing Information Returns Electronically) for businesses, and some third-party services may provide free or low-cost e-filing options for this form. - Where can I find a free 1099-NEC printable form?

You can easily obtain a blank 1099-NEC by following the link from our website. It is available to download in PDF format, which you can then print and fill out as needed. - How do I ensure that my 1099-NEC template is accurate?

To guarantee that your free template of the 1099-NEC is accurate, always download it directly from a reliable source, preferably the IRS website or a trusted tax software provider. This ensures that you're using the correct version for the current tax year and following the latest IRS guidelines.

Wrapping up handling the printable 1099-NEC form for 2023 for free can seem daunting, especially in unique situations. However, with accurate templates, the option to file the form online for free, and resources for correcting mistakes, you can navigate this essential tax document with confidence.

Free 1099-NEC Printable Form

Free 1099-NEC Printable Form

IRS Form 1099-NEC in PDF

IRS Form 1099-NEC in PDF