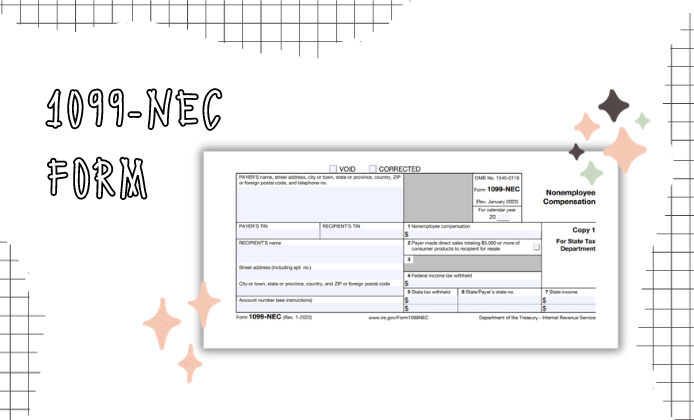

If you're a freelancer, independent contractor, or self-employed, you've likely come across IRS Form 1099-NEC. This form is used to report income you receive from clients or companies for which you perform services but are not an employee. Essentially, if you get paid more than $600 in one year from a business for your work, the business must send you this form by January 31, following the year of payment. This helps the IRS track income that isn't subject to automatic withholding like a traditional salary.

Characteristics of the 1099-NEC Editable PDF

Dealing with the digital version of the 1099-NEC form in PDF is all about convenience and accuracy. You can easily find the 1099-NEC form in PDF for download from our website. This form can be filled out on your computer, which makes it less likely to contain the errors that hand-written forms might have. Moreover, using an electronic copy ensures that you always have a digitally stored version for your records, accessible anytime and anywhere.

Having the form available as an IRS 1099-NEC form in PDF also simplifies the submission process. You can directly type in your information using compatible software, and some versions of the form can even perform calculations for you. This reduces manual effort and helps ensure that the values entered are correct.

Online Submission of Form 1099-NEC

While submitting your 1099-NEC online is efficient, it can come with certain challenges.

- Sometimes, you might encounter technical difficulties such as website downtimes or issues with internet connectivity.

- Additionally, the format may not be compatible with all PDF readers, so having updated software is key.

- Another potential hurdle is the complexity of tax rules which, if misunderstood, can lead to mistakes when filling out the form.

Also, it is important for filers searching for a printable 1099-NEC form for 2023 in PDF to ensure that they use the version that corresponds with the tax year they are reporting on. Since tax laws and forms can change from year to year, using an outdated form could result in having to refile, delaying any due payments.

1099-NEC Online Form: Protecting Your Data

Filing your 1099-NEC form electronically means dealing with sensitive information that must be kept secure.

- Employ strong passwords to protect documents, and consider using encrypted storage solutions to keep your digital files safe.

- Be cautious of phishing scams by only downloading the 1099-NEC form in an editable PDF from a reputable site.

- Remember, the IRS does not send emails asking for personal or financial information.

- Finally, make sure that your computer's security software is up-to-date to ward off any malicious software that could compromise your personal data.

In summary, electronic filing of the IRS Form 1099-NEC in PDF can streamline the tax process for individuals. By paying attention to the specific requirements of the digital form and taking appropriate steps to secure sensitive information, you can effectively navigate potential obstacles to ensure a smooth submission.

Free 1099-NEC Printable Form

Free 1099-NEC Printable Form

IRS Form 1099-NEC in PDF

IRS Form 1099-NEC in PDF